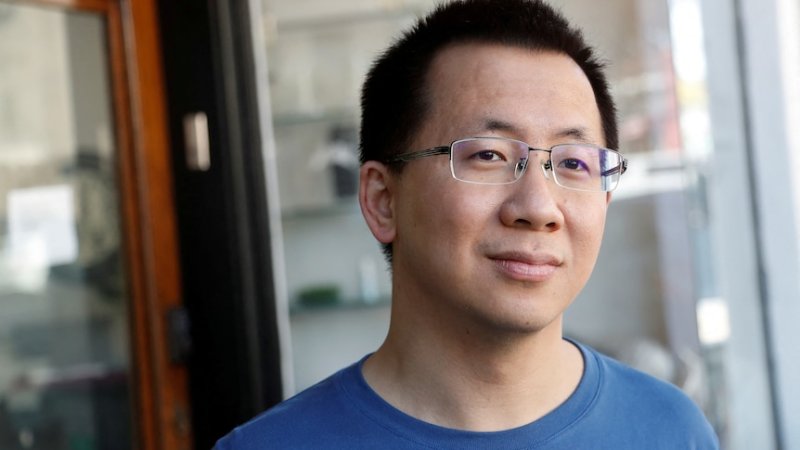

According to a rich list produced by the Hurun Research Institute, Zhang Yiming is now worth $49.3bn (£38bn) - 43% more than in 2023.

The 41-year-old stepped down from his role in charge of the company in 2021, but is understood to own around 20% of the firm.

TikTok has become one of the most popular social media apps in the world, despite deep concerns in some countries about its ties to the Chinese state.

While both companies insist they are independent of the Chinese government, the US intends to ban TikTok in January 2025 unless ByteDance sells it.

Despite facing that intense pressure in the US, ByteDance's global profit increased by 60% last year, driving up Zhang Yiming's personal fortune.

“Zhang Yiming is the 18th new Number One we have had in China in just 26 years," said head of Hurun Rupert Hoogewerf.

"The US, by comparison, has only four Number Ones: Bill Gates, Warren Buffett, Jeff Bezos and Elon Musk.

"This gives an indication of some of the dynamism in the Chinese economy."

Zhang is not the only representative of China's huge tech sector on the list.

Pony Ma, boss of the tech conglomerate, Tencent, is third on the list with an estimated personal wealth amounting to £44.4bn.

But their fortunes are not just explained by their companies successes - their rivals have made less in a year in which china's economy has sputtered.

In fact, only approximately 30% of the people on the list had an increase in their net worth - the rest saw a decline

“The Hurun China Rich List has shrunk for an unprecedented third year running, as China’s economy and stock markets had a difficult year," said Mr Hoogewerf.

"The number of individuals on the list was down by 12% in the past year to just under 1100 individuals and 25% from the high point of 2021."

He said the data showed it had been a good year for smartphone manufacturers such as Xiaomi, while the green energy market had stumbled.

“Solar panel, lithium battery and EV makers have had a challenging year, as competition intensified, leading to a glut, and the threat of tariffs added to uncertainties," he said.

"Solar panel makers saw their wealth down as much as 80% from the 2021 peak, whilst battery and EV makers were down by half and a quarter respectively."

--BBC